Conclusive ThoughtsFirst

-

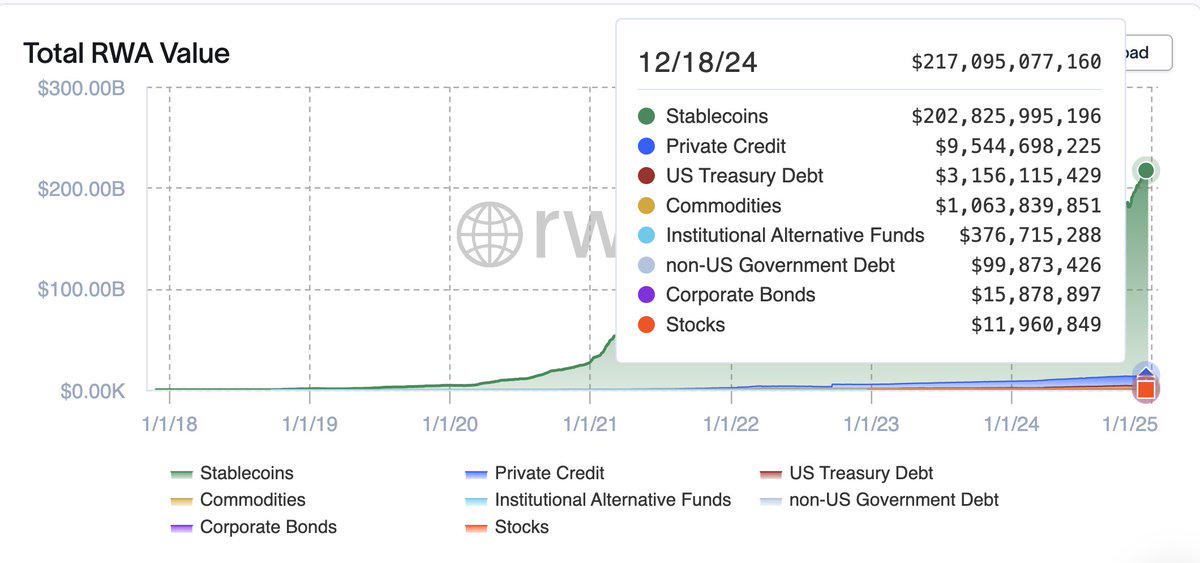

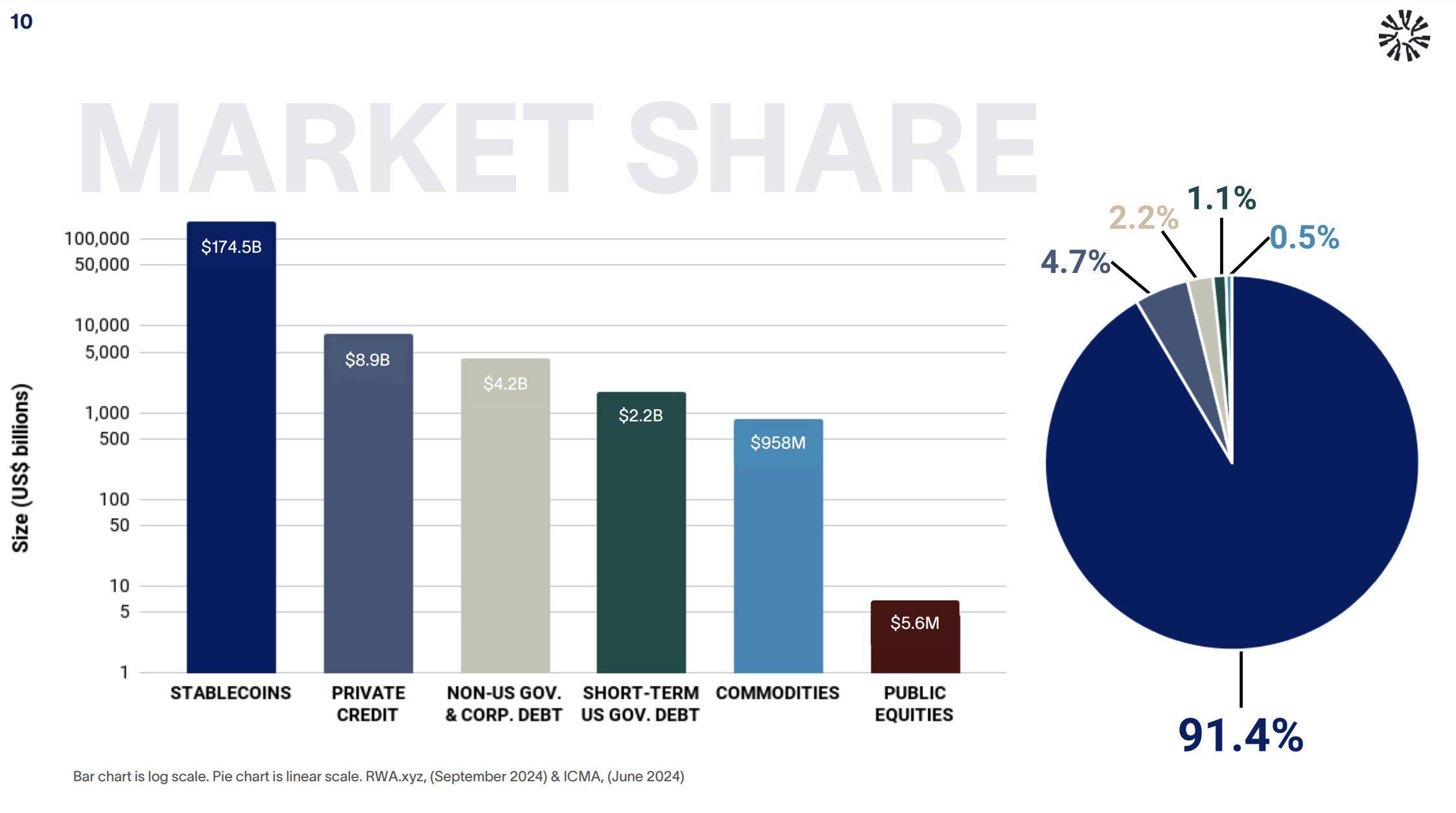

RWA covers a broad range of assets, but the most promising remain stablecoins, U.S. treasuries, and private credit.

-

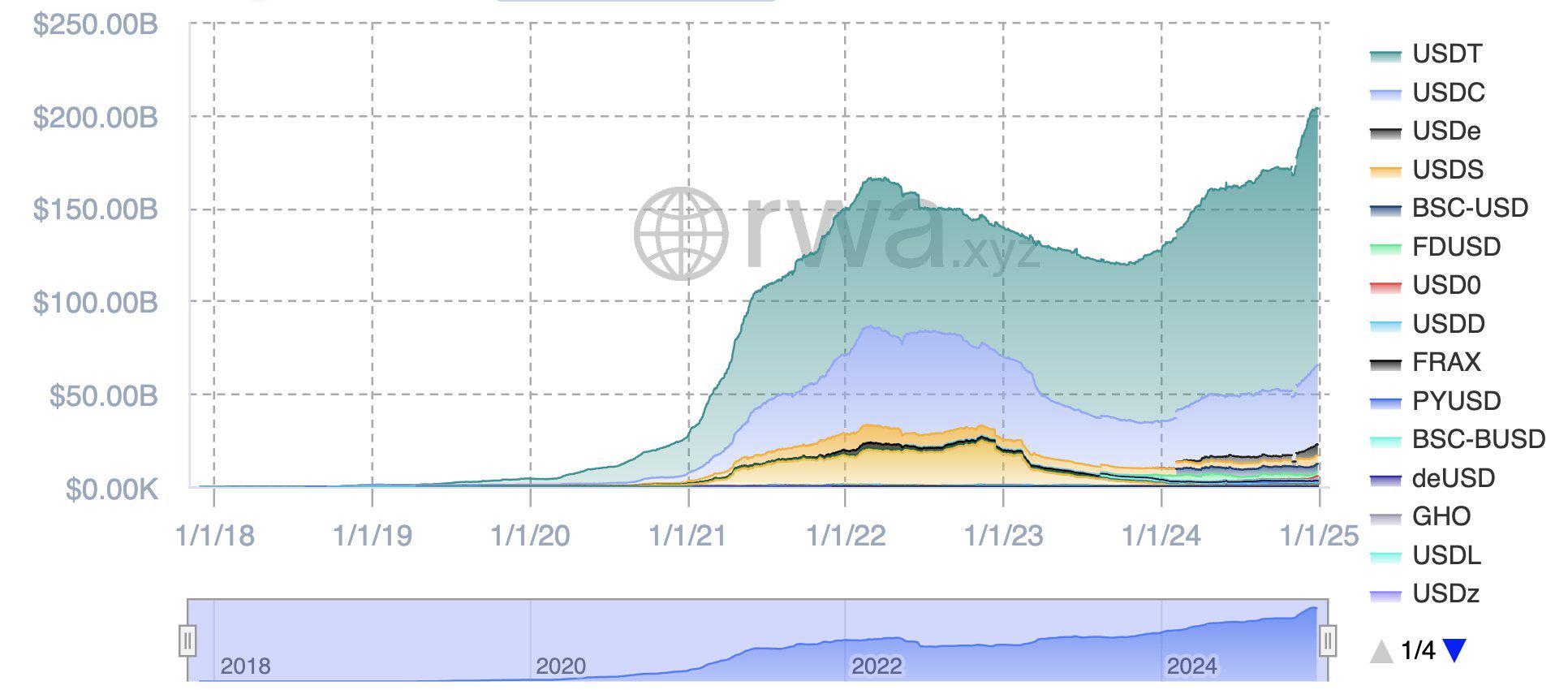

The stablecoin market is dominated by three key players and is likely to stay that way.

-

U.S. treasury protocols mainly differ in fees and accessibility for retail investors, though reputation remains a critical factor.

-

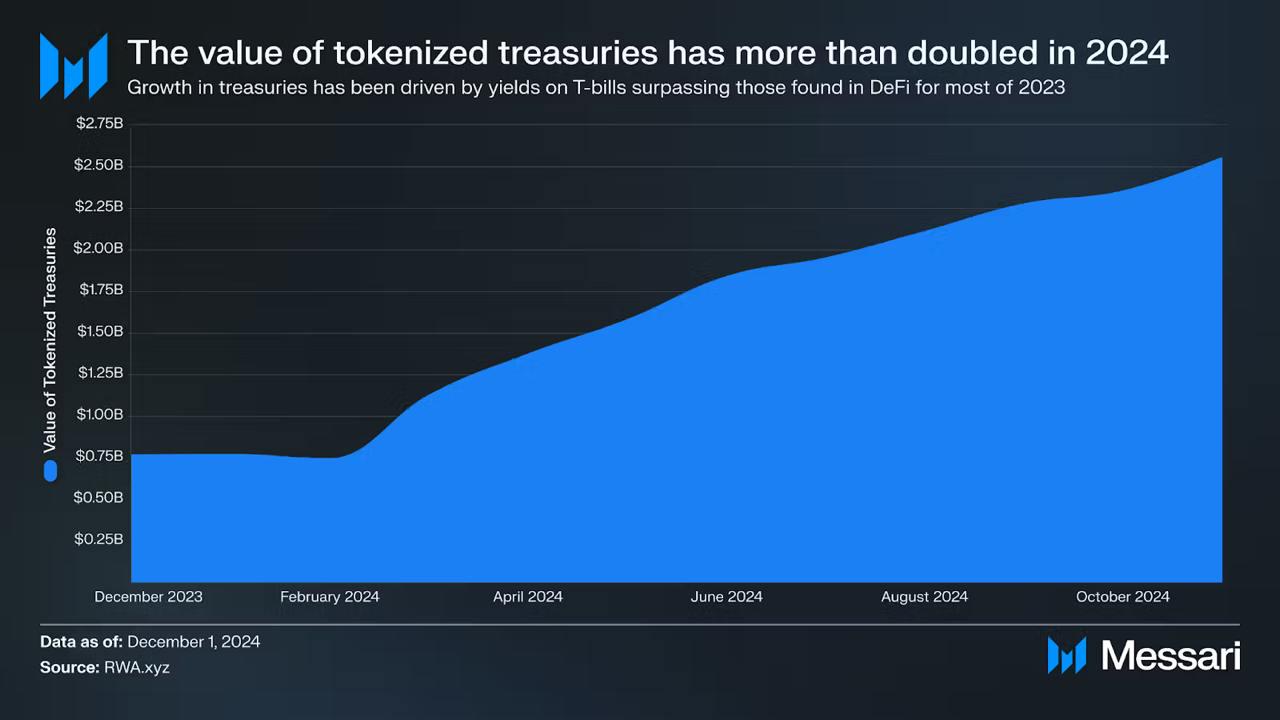

A reduction in U.S. Fed interest rates will lower treasury yields, diminishing the incentive to hold new treasuries.

-

Despite this, U.S. treasury protocols continue to attract significant attention and funding.

-

Private credit models rely on attracting creditworthy businesses to minimize default rates.

-

Improving illiquidity and default repayment issues could position private credit as a key growth area within RWA.

So, what isRWAs?

RWAs (Real World Assets) refers to tokenizing real-world items like stablecoins, US treasuries, and private credit to bring them on-chain. This bridges traditional finance and decentralized finance, unlocking new opportunities for liquidity and accessibility.

Why Do RWAsMatter?

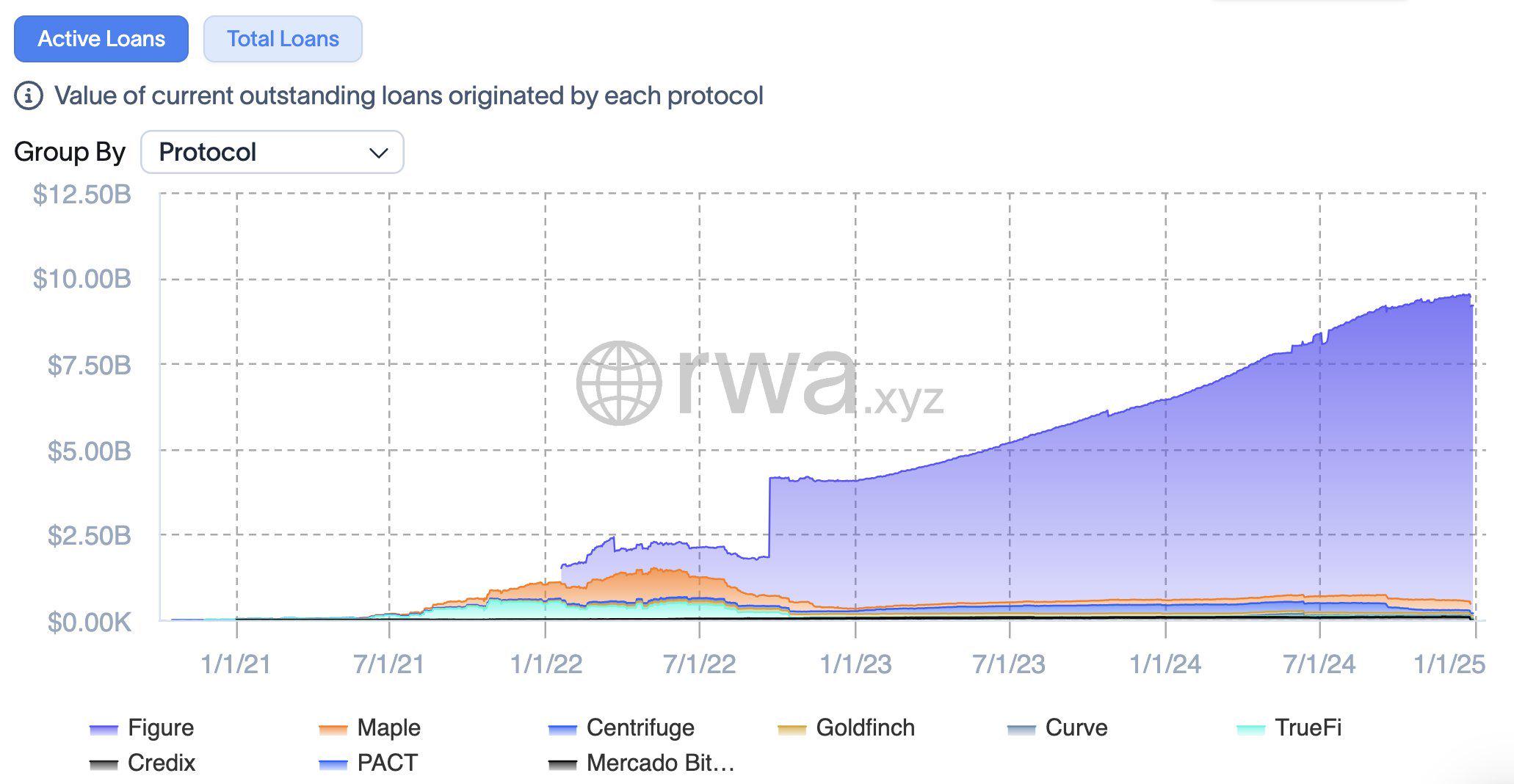

With a total value locked increasing from $2B to $9B(excluding the stablecoin market), merely a fraction of TradFi’s total assets, the growth potential for RWA is immense.

Tokenized assets like bonds, real estate, gold, and lending are just the beginning. Tokenization unlocks a global asset pool, democratizes investor access, and creates new revenue streams for issuers and intermediaries, paving the way for transformative opportunities in the financial ecosystem.

(Source: Messari)

How does Blockchain Improve Traditional RWAs?

RWAs unlock vast untapped markets for tokenization, offering:

Increased Liquidity: Traditional finance limits trading to set hours, but tokenized assets enable 24/7 trading, ensuring seamless transactions.

Fractional Ownership: Invest in high-value assets like real estate with fractional ownership.

Transparency: Auditing and token issuance post-asset custody ensure greater security and investor confidence.

Challenges FacingRWAs

While RWA offers a large market size and stable value, it still struggles with key challenges like low liquidity, limited transparency, and trading inefficiencies:

Regulatory Hurdles — Adhering to laws and regulations tied to tangible assets can be complex, with the risk of legal issues post-launch.

KYC Requirements — Both issuers and investors must undergo KYC to comply with AML/CFT standards, raising centralization concerns.

Custody & Security — Strong security measures are essential to ensure collateralized assets are safe and not misused.

Default Risks — Private credit within RWA carries significant default risk, unlike DeFi loans, which lenders can manage through overcollateralization.

Key Categories BreakDown

(Source: tokenizedassetcoalition.com)

1. Stablecoins

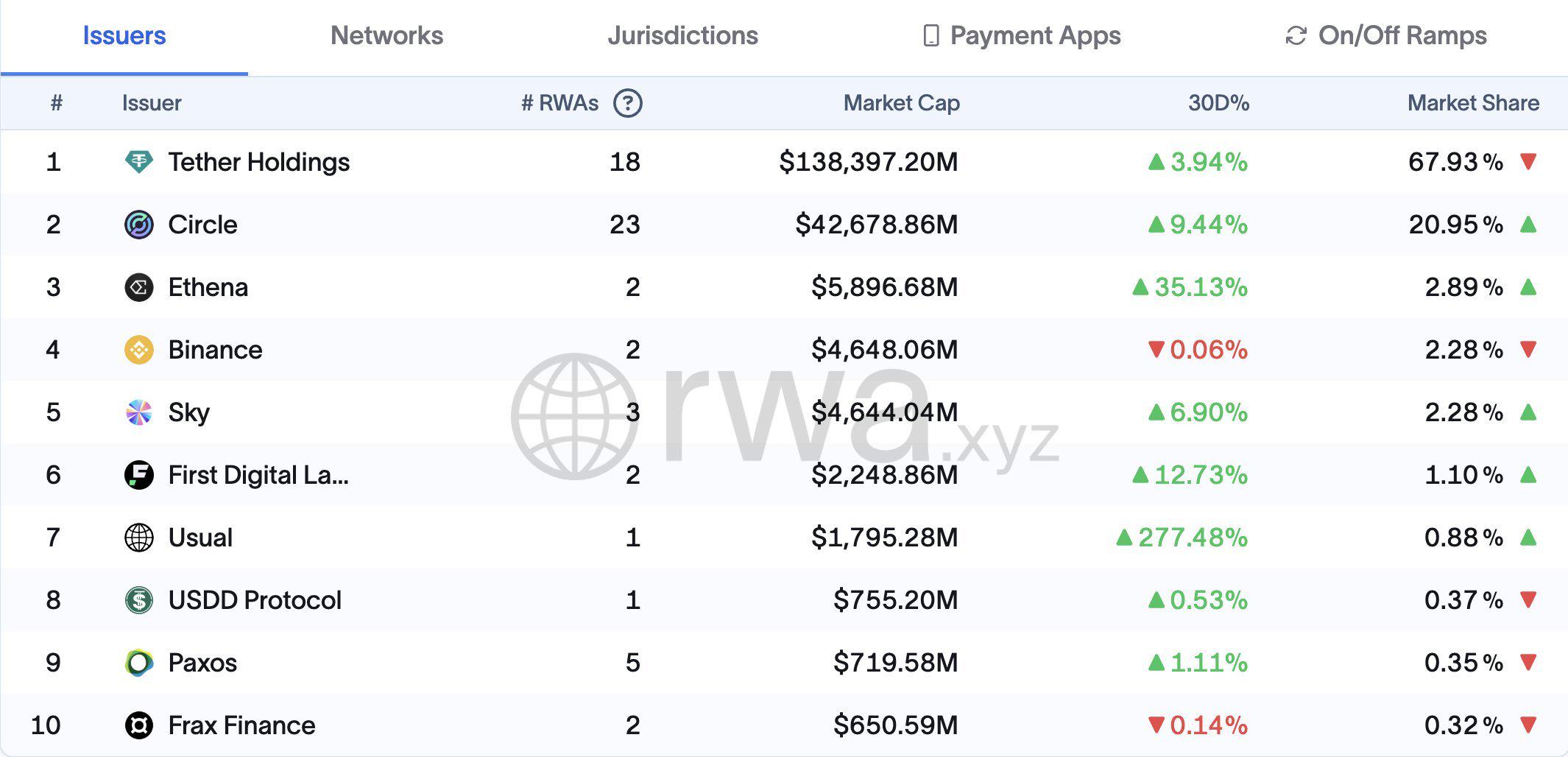

◇ The total MC of stablecoins reached $203.38B by the end of 2024.

◇ Held by 139.51M accounts globally.

◇ The majority of stablecoins are dominated by USDT and USDC, backed by USD, U.S. Treasury bills, and cash equivalents etc.

◇ While the market is smaller, algorithmic stablecoins, over-collateralized stablecoins, and tangible asset-backed stablecoins also play a role in the ecosystem.

2. Private Credit

◇ The total value of active loans stands at $9.49B, with a cumulative loan value of $16.23B.

◇ Unlike the over-collateralized lending structure in DeFi, private credit protocols provide collateralized lending.

◇ Deliver yields comparable to, or even better than, those in TradFi and, in some cases, DeFi.

◇ Make borrowing easier for businesses while offering lenders better rates compared to traditional banks.

◇ Act as intermediaries, the protocols connect external companies seeking funds with crypto lenders.

Pros:

-

Senior Pool APY offers higher yields than many DeFi and UST options.

-

Loan counterparties are typically vetted, well-established companies.

Cons:

-

Repayment issues from counterparties can lead to defaults, impacting yields and causing potential losses.

-

Low liquidity makes exiting private credit pools challenging.

-

Default management by junior pool investors lacks transparency for general users.

3. Treasury/bonds

◇ The total value of treasury and bonds are 116.45B.

◇ U.S. T-Bills dominate the treasury market, backed by the U.S. government’s guarantee of interest and principal repayment.

◇ Bonds from other countries exist but are less traded and less liquid.

◇ Gained popularity in 2022 and early 2023 due to rising U.S. Fed interest rates.

◇ The high-interest environment, coupled with the crypto bear market, offered competitive yields.

4. Commodities

◇ The MC of commodities is $1.05B.

◇ Monthly Transfer Volume of commodities is $263.34M.

◇ Mostly dominated by gold, with other types like oil, metals, and uranium also included.

Pros:

1. Enables on-chain access to gold products.

Cons:

-

Apart from gold, other on-chain commodities are not widely adopted by traders.

-

Low liquidity and trading volume make some commodities susceptible to price manipulation.

5. Real Estate

Pros:

1. Allows smaller investors access to high-value assets via blockchain.

Cons:

-

Most platforms have high entry barriers, like Propy as a listing platform or Tangible requiring pledged property.

-

Low liquidity limits trading opportunities for tokenized RWAs.